The Global Landscape: Understanding How Many Dental Implant Companies Exist

Table of Contents

- Global vs. Regional Presence

- Tiered Structure of the Market

- Mergers, Acquisitions, and Constant Change

- What Counts as a “Company”?

- Market Size and Growth

- Who Holds the Power? Market Share Distribution

- Key Drivers of Growth

- Major Regional Differences

- Parts and Components

- Digital Dentistry Solutions

- Biomaterial Providers

- Education and Training Providers

Introduction: Demystifying the Dental Implant Industry

If you’re like me, the first time you step into the world of dental implants, it feels huge and a bit confusing. Maybe you’re a dentist wondering which brands you can trust, a patient curious about the implant in your mouth, or even an investor looking for a good business. One of the questions I hear all the time is, “How many dental implant companies are out there?”

That question isn’t as simple as it sounds. The market is big and spread out, with hundreds of names if you count every maker and supplier worldwide. But only a few big companies really run the industry. I’ve watched this field for years, working with both small local labs and big global brands. Here’s how it looks to me—and what I wish I knew when I first started looking for these numbers.

Why It’s Hard to Pin Down an Exact Number

Global vs. Regional Presence

The more I looked into it, the more I saw: where you are matters. The brands you see all over the United States might barely exist in Asia or Europe. While big names like Straumann and Nobel Biocare are found everywhere, smaller brands may only serve a city or region. So if someone asks me, “How many implant companies are there?” I have to reply, “Where are you talking about?”

Tiered Structure of the Market

As I sorted the companies by their size and reach, clear groups showed up. Here’s how I see it:

- Tier 1: Major Global Players

These are the big ones: companies with big research budgets, selling in almost every country, with lots of products. Think Straumann Group, Dentsply Sirona, Nobel Biocare (which is owned by Envista Holdings), Zimmer Biomet, and Henry Schein (BioHorizons, Camlog). These companies don’t just make implants; they set trends and lead the way.

- Tier 2: Mid-Sized and Regional Leaders

These companies often have loyal followers in certain countries or focus on special kinds of implants. For example, Osstem and DIO are huge in South Korea and parts of Asia. Sweden & Martina and Cortex are well-known in some parts of Europe and the Middle East.

- Tier 3: The Specialists and Newcomers

This is where it gets confusing—and messy. There are hundreds, maybe thousands, of companies here. Some just make parts like abutments, others sell products under different names to clinics, while others focus on new materials like zirconia. Many are startups or smaller local brands hoping to grow bigger.

Mergers, Acquisitions, and Constant Change

If you think you have the list figured out, you don’t. The market is always moving. A new company might come up with a new way to make implants, while two others might merge or get bought by a big player. The big companies are always looking to buy the next new thing. Almost every time I check the business news, there’s a new deal or a new company showing up.

What Counts as a “Company”?

Here’s another twist: not all companies in this space really make implants. Some design and sell only small parts like screws. Others work just on software for planning the surgeries. Some make products for others to sell under a different name. So when industry experts say there are “200 to 500” companies, they’re including a lot of different businesses. My own guess is about 200 or more real makers, but the number gets much bigger if you count everyone selling parts, software, or their own labeled products.

Who Are the Major Players? Dominant Dental Implant Companies

The “Big Four” (or Five)

Any time I give a talk or chat with other dentists, I hear the same few names—because they are the biggest and most talked about:

Based in Switzerland, Straumann is a leader for quality and research. They have bought or joined with other brands like Neodent and Medentika, giving them even more reach.

Their size goes beyond implants—they are also big in equipment and digital dentistry. If a clinic moves toward full digital treatment, Dentsply Sirona gear shows up pretty quickly.

Nobel Biocare was there from the start of modern implantology. Now, with Envista Holdings as the parent, they also own companies like Implant Direct.

If you talk about high quality and full service, Zimmer Biomet is always included. Their strong research focus keeps them on top dentists’ lists.

Known well in North America and Europe, their brands (BioHorizons, Camlog) are trusted by many for good results.

What Sets the Leaders Apart?

All these big companies have some key things in common:

- They spend a lot on research and new ideas.

For example, Straumann bought Medentika for its digital implant technology, helping Straumann do more digital work.

- They can get their products to almost anywhere.

Even friends of mine working far from big cities can get parts or help from these giants.

- They have full lines of products.

Whether I need a solution for a few teeth, a single implant, a zirconia option, or a custom-made part, these big names offer it all, making it easy for clinics to stick with one brand.

- They provide lots of research and doctor training.

What made me stick with these brands years ago was the amount of good studies and help they provide. If I want proof an implant system works well, they show it.

Regional Specialists and Innovators

But don’t think only the giants matter—there are exciting regional leaders and companies doing new things. Here are some I keep my eye on:

- Osstem Implant (South Korea): Huge in Asia, great if you want simple, lower priced systems.

- DIO Corporation (Asia): Big in digital implant treatments, offering surgical guides and planning.

- Sweden & Martina, Euroteknika (Europe): Known for their engineering and build quality.

- CeraRoot, Z-Systems: Only make zirconia (metal-free) implants for people who don’t want any metal.

- MegaGen, Dentium: Popular throughout Asia and parts of Europe, known for creative ideas.

My advice: If you run a clinic or want a partner, don’t just look at global leaders—local or special brands might meet your needs even better.

Dental Implant Market Dynamics and Statistics

Market Size and Growth

I like keeping track of numbers—they tell the story. From what I see, the global dental implant market in 2023 was about $5.5 to $6.0 billion USD. If things keep going this way, the market could grow to $9 to $11.5 billion by the end of this decade. That’s a yearly growth between about 6% and 8.5%. Pretty good, right?

Who Holds the Power? Market Share Distribution

One stat that always stands out to me—about 70% to 80% of all the world’s dental implant money goes to the top five brands mentioned above. It’s like only a few players score most of the goals, and the rest of the teams fight for what’s left.

Key Drivers of Growth

Wondering what’s making this market grow? From what I see and read, here are the main things:

- People are living longer:

As we get older, more of us lose teeth and need implants.

- More people know about implants:

Thanks to social media and better dental education, people are less scared about getting implants.

- New dental tech:

Things like digital dentistry are changing the way we work. I remember seeing my first 3D scan become a surgical guide for placing implants.

- Dental tourism:

Some people travel far for cheaper, good quality dental care. That means the market isn’t just global in talk—it really is global.

Major Regional Differences

If you go to dental meetings worldwide or talk with other dentists, you see the differences. North America (mostly the U.S.) has about 35-40% of the market. Europe gets about 30-35%, and Asia Pacific around 20-25%. One thing to note: Asia-Pacific is growing fastest, thanks to more dental education and people having more money. I’ve seen clinics in China and India getting busier as people learn more about dental health.

Talking about China, I’ve worked closely with a china dental lab and seen their speed and new ideas—it’s hard to beat if your clinic treats patients from all over the world.

Beyond Manufacturers: The Broader Dental Implant Ecosystem

Parts and Components

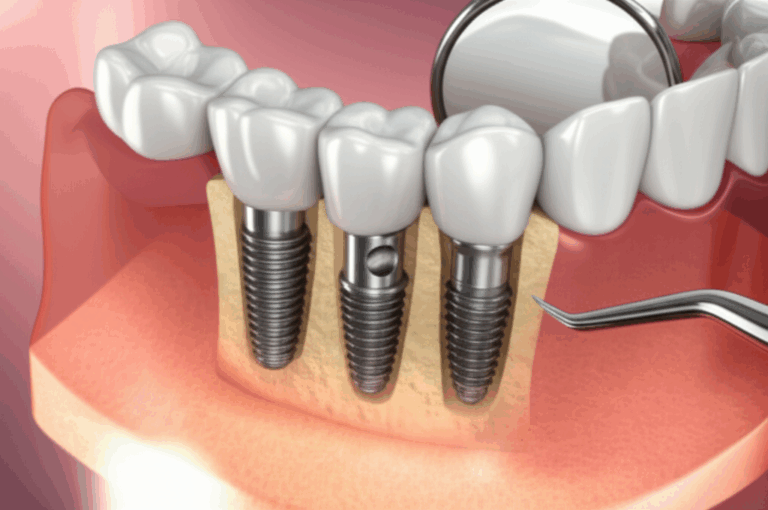

Don’t forget the groups making important implant parts—everything from abutment screws to custom supports. My daily dental work depends on finding a good implant dental laboratory for custom abutments, crowns, or even surgical guides. These labs don’t just work with one brand; they often handle parts from many companies, which is key for a good implant case.

Digital Dentistry Solutions

The digital world didn’t skip dental implants. Companies and labs working with digital scans and workflows (like digital dental lab services or 3D printed guides) are now must-have partners, handling design, planning, and making the pieces we need. Using digital tools in my practice has made things faster and better for patients.

Biomaterial Providers

The field of bone grafts, membranes, and other helper materials is like its own market. Companies like Geistlich are trusted for their research and solid products. Picking the right bone graft or membrane often means working with a special supplier, not just your implant brand.

Education and Training Providers

I’ve learned one thing—never stop learning. Whether it’s intensive courses organized by groups like the International Congress of Oral Implantologists (ICOI) or hands-on training from the European Association for Osseointegration (EAO), keeping up with learning helps me stay good at my work and offer the best care.

How I Choose an Implant Company—What to Consider

When you’re facing a table full of brochures from all kinds of implant companies, here’s my go-to checklist—made from both my wins and mistakes:

- Product Quality and Materials:

I always look for FDA or CE Mark approval, ISO quality checks, and proven history in clinical studies. For example, more than 90% of implants on the market are still titanium—they last and work well.

- Success in the Real World and Research:

Brands with lots of real-life trial data—like Straumann or Nobel Biocare—give me confidence that these implants will work for my patients.

- Company Support and Warranty:

A good, clear warranty and having backup parts easily available is a life-saver. Quick help from a lab once saved a patient’s smile in my office.

- Works with Many Systems:

Using implants that have widely available parts makes my day smoother. I don’t have to hunt for a special screw or abutment mid-surgery.

- Price vs. Top Brands:

Sometimes, the patient’s budget makes me pick lower-cost brands; other times, the case is tough or the look matters, so I go with a top brand. When not sure, I ask my trusted crown and bridge lab for advice—they know which brands really last.

And reputation matters. I check with fellow dentists, read reviews, and listen to feedback from experienced labs before trying a new system.

Conclusion: A Constantly Evolving Industry

So, how many dental implant companies are there? From what I’ve seen, the quick answer is: hundreds, on every continent, covering every part of the field. The long answer? The number keeps changing. New companies start, others join forces or disappear, and the big guys keep buying up new ideas.

One thing doesn’t change: people are always working for better, safer, and easier implant options. For someone like me, that’s both a job and an adventure. There are so many choices, and a whole network of makers, labs, and teachers driving dentistry forward.

If you want my advice—whether you’re a dentist, a patient, or a business person—stay curious, stay up to date, and always expect high quality. The world of dental implants is big and sometimes a bit crazy, but that’s what makes it so interesting.

If you want to learn even more, you might want to check out topics like dental implant procedures or see how a good digital dental lab is changing how patients get treated. The future looks good—and there’s room for anyone who wants to help make things better.