Do Anthem Dental Insurance Plans Cover Dental Implants?

Table of Contents

When my dentist told me I might need a dental implant, my stomach dropped. I knew implants cost a lot, and I had no clue if my insurance from Anthem would help at all. Some friends told me their plans helped a little, others paid everything themselves. The more I looked, the more mixed up I got—every plan seemed different. But I kept digging. I picked up the phone, read the tiny print, asked every “dumb” question, and wrote down everything. If you’ve ever wondered “does Anthem cover dental implants?”—you’re not alone. Here’s what I found, what surprised me, and what I’d do if I were you so you don’t end up with a huge bill—or a bigger headache.

Do Anthem Dental Plans Cover Implants? The Short Answer

Let’s get right to it. Does Anthem cover dental implants? After hours of calls, reading a pile of benefit booklets, and hearing a few “let me check with my boss” answers, I say: maybe.

What I learned:

- A lot of Anthem dental plans give some implant coverage—but details really matter.

- If they cover it, it goes under “Major Services.” That sounds good, but the real numbers can be complicated.

- Some plans say no to implants, others cover a part, always with some limits.

In my case, my Anthem PPO plan did cover dental implants, but only after I paid the deductible, and only for some of the cost. Friends with other Anthem plans—like Anthem Blue Cross or Anthem HMO—found things worked a bit different, some not even covering implants. So, don’t assume you’re covered, but don’t lose hope till you check!

Key Factors That Shaped My Anthem Dental Implant Journey

Every plan has its own odd things, and these were the biggest things for me—and others I talked to.

Plan Type: PPO, HMO, and Plan Tiers

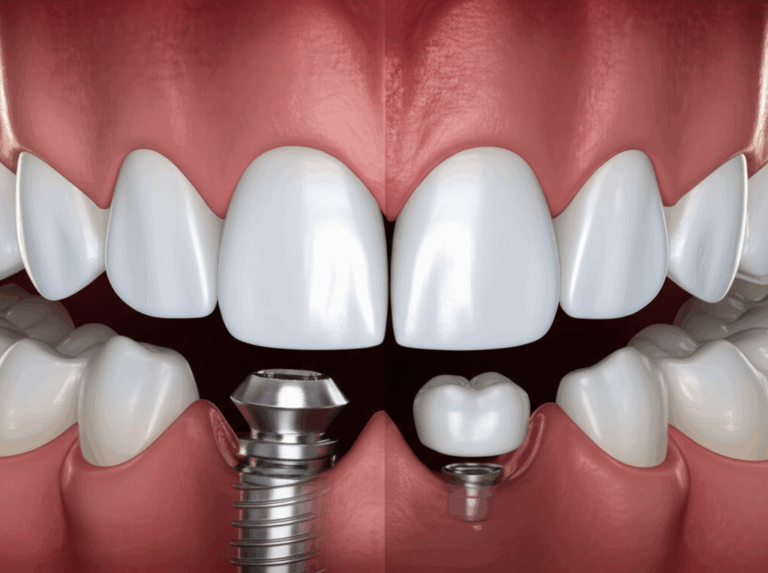

First up, know what plan you have. I had a PPO, but Anthem has HMO and other dental plans too. PPOs usually let you choose your dentist and often pay better for “big” things like implants. HMOs might cost less each month but have stricter rules and fewer dentists, sometimes with less or no implant help.

It also matters if your plan is from your job or if you bought it yourself. Work plans can have better benefits, but not always. The “fancy” or “deluxe” plans are more likely to pay for implants—though you still need to check the details.

Deductibles and Major Services

Deductibles confused me at first. With my plan, I had to pay $100 myself each year before insurance paid anything for major stuff, including implants. Pretty normal. So if you want an implant, think of the deductible as a toll booth—you can’t get help from insurance till you pay it.

Co-insurance and Example Calculation

After the deductible, you still pay part. Most plans only cover a part of the implant bill. With mine, after the deductible, Anthem paid 50% for big services. So, if my implant (with crown and abutment) cost $4,000 and the deductible was already taken care of, insurance paid $2,000, and I paid $2,000.

Quick breakdown:

Friends had all kinds of coverage—some had nothing, others 40% or even 60%. Always check your own plan.

Annual Maximums

Insurance companies don’t give unlimited money. My yearly max was $1,500. If you need more than one implant, Anthem only pays up to $1,500 that year, any more is on you. Since implants can run $3,000 to $6,000 a tooth, you hit your plan’s max real fast. Some folks spaced their work over two years to get more from their annual max.

Waiting Periods and Why They Matter

Here’s another sneaky thing. After I signed up, I found out Anthem makes you wait for major work, like implants. For new customers, this was 12 months. If you need an implant now but haven’t passed the waiting time, you’ll pay it all. This waiting period catches a lot of folks off guard, don’t miss it.

Medical Necessity vs. Cosmetic Reasons

When it comes to implants, insurance wants to see “medical need.” Anthem and others want proof that your implant isn’t just for your smile, but so you can chew, talk, or stay healthy. If you lost a tooth in an accident, sometimes your health insurance can help too. But if you just want to look better, don’t expect Anthem to pay.

Pre-authorization: My Experience

My dentist and I asked Anthem ahead of time if they’d pay for the implant—a thing called pre-authorization. It wasn’t required, but I’m glad we did it. Anthem sent back a letter showing what they’d pay, which saved me a shock later. My tip: always do pre-authorization, even if your dentist thinks it’s not needed.

Network Dentists and Out-of-Network Costs

Anthem has a list of dentists they work with (in-network). If you use them, you get lower prices and more help from insurance. Go outside the network? You might still get something, but less, and pay more. When I saw how much cheaper it was in-network, I called around, used Anthem’s dentist search, and picked one who knew the implant process.

How I Verified My Anthem Dental Implant Benefits

Figuring out if I really had implant coverage felt like solving a puzzle. Here’s how I did it.

Plan Documents and Benefit Booklet

I started by logging into Anthem’s member site, downloaded my benefit book, and searched for “major services,” “dental implants,” and words like “crown” and “abutment.” Most plans list what they pay, what they skip, and what you pay. If yours is as long and confusing as mine, just call Anthem and ask!

Online Portal Access

Anthem makes it easy to check your plan online. Once I had an account, I found:

- My annual maximum and deductible details.

- A list of “major services” covered.

- A way to search for in-network dental implant dentists and see estimates of cost.

If you’re not logged in, you might miss things that match your actual plan.

Anthem Customer Service Insights

Honestly, calling them helped me most. I gave them my plan info and asked:

- “Does my plan pay for dental implants?”

- “How much do you pay, is it part of my annual max?”

- “Is there a waiting period for me?”

- “Do I need to get permission first?”

The person on the phone went over not just the basics, but warning signs, like “this plan skips some types of implants” or “bone grafting may not be covered.” Ask every question—even small ones.

Asking My Dentist’s Office for Help

Dentist offices work with insurance all the time. Mine helped send all pre-authorization forms and gave me a full list of expected costs. This showed me what I’d pay now and what Anthem might pay back. Use your dental office for help—they know which codes to use so you get the best shot at coverage.

If you’re wondering about the type of implant—like if you need a zirconia lab or something else—your dentist can explain not just what’s best for you but what your plan might cover.

Crunching the Numbers: Understanding Out-of-Pocket Costs

Dental implants cost a lot. For just one implant (surgery, post, abutment, crown), my bill was over $4,000 at my local dentist. Even with Anthem, I still owed more than $2,000 because of the yearly max and how we split the bill.

Here’s my breakdown:

If you need more than one implant (like an All-on-4 job), insurance can run out super quick—your yearly cap just isn’t enough. One friend needed a bunch of teeth done and split the work into two years to get two years of their max.

If you’re curious about details, sometimes knowing if a special dental lab is needed can change both cost and coverage. Insurance usually cares more about the type of work, not the lab used.

Alternatives I Considered When Implants Seemed Out of Reach

When I saw my bill, I looked at cheaper choices. Here’s what my dentist talked about:

- Dental Bridges: These use your nearby teeth to fill the gap and are often covered better (and for less) than implants by most dental plans. Usually, they count as “major services,” just like implants.

- Partial or Full Dentures: Not always super comfy, but much cheaper. Anthem covered dentures better than implants in my case, though keeping them fitting well can be tough over time.

- Payment Plans: Some dentists will let you pay over time, sometimes no interest. Or you can get outside financing to spread out payments instead of paying all at once.

For more info, I found the dental implant article at iStar Dental Design really helpful and easy to understand.

Making a Confident Decision: My Closing Advice

Here’s what it all came down to for me: Don’t assume anything about your dental insurance. I’ve met people who skipped checking and got bills they couldn’t handle—or who thought they had no coverage, but really did if they just asked more questions.

Here’s what I learned:

- Every Anthem dental plan is different. The details—what you pay first, how much they cover each year, percent paid, waiting times—matter a lot.

- Always check your plan yourself. Use the website, call Anthem, talk to your dentist, and ask for pre-authorization before you start the implant work.

- Don’t forget other options. Sometimes a bridge or denture—especially from a good removable denture lab—just makes more sense if you can’t afford an implant.

Most of all: you’re not alone, and asking questions can save you from surprise bills. Insurance is confusing, but if you keep at it, you can make smart choices for your teeth and your budget.

Frequently Asked Questions About Anthem Dental Implant Coverage

Q: Does Anthem dental insurance always cover implants?

A: No; it depends on your plan. Some cover implants as a major service, others don’t pay anything.

Q: How much can Anthem help pay?

A: If they cover it, Anthem often pays 50% for major work after your deductible. But it’s only up to your annual max (usually $1,000–$2,500 a year).

Q: Do I need to wait before implants will be paid for?

A: Most plans have a 6–12 month wait for implants if you just joined.

Q: Does Anthem cover things needed for implants, like bone grafts?

A: Not always. Stuff like bone grafts and other prep work are often skipped or paid less, even if the implant is covered.

Q: Is pre-authorization really needed?

A: I think yes! Getting an answer in writing helps you know what’s covered and what isn’t.

If you’re making this choice, slow down, gather your info, and ask every question—even ones you think are silly. I’ve been there, and asking saved me from big headaches and maybe even a lot of money. Your teeth—and wallet—will be glad you did.