How to Get Insurance to Cover Dental Implants: My Step-by-Step Guide to Maximizing Coverage

Table of Contents

- Major vs. Cosmetic

- Annual Maximums and Waiting

- Pre-existing Conditions, Exclusions

- PPO Plans and Coverage Details

- When Medical Insurance Can Help

- Dental Discount Plans

- Seniors, Veterans, and Special Cases

- Pre-authorization and Predetermination

- Splitting Procedures by Plan Year

- Arguing Medical Necessity

- Appeals and Denials

- Breaking Up Billing for More Coverage

- Dental Financing Solutions

- Using HSAs and FSAs

- Dental Schools as a Smart Option

- Grants and Charitable Aid

- Negotiating with Your Dentist

Introduction: Why Getting Dental Implants Covered Feels So Hard

I remember when my dentist told me I needed a dental implant. My first thought? “How much is all this going to cost?” Then, “Will my insurance actually pay anything?” If you’re like me—looking at a huge bill—you’re probably wondering if your dental insurance will help at all. Bad news is, it often doesn’t pay what we hope.

But here’s what I learned after a lot of phone calls and letters—there are ways to get a bit more help from insurance. Over the years, I’ve helped my friends, my family, and myself get more from dental insurance than I thought was possible. Let me show you what I learned, so you can go into your dental implant plans ready to save money and feel in control.

Why Dental Insurance Usually Falls Short for Implants

Before you start expecting insurance to cover everything, here’s what I found out the hard way.

Major Procedure or Cosmetic? (It Matters)

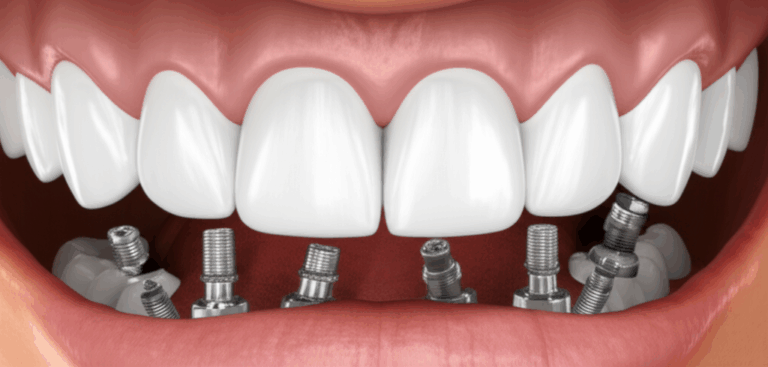

Most dental insurance companies call implants “major work,” but sometimes they say they’re just “cosmetic.” This isn’t just tricky wording. If your plan says an implant is cosmetic, they won’t pay at all. Even if it’s called a major procedure, coverage is usually about 50% at most, and you don’t get the full cost covered, especially with low yearly limits.

Annual Maximums: The Hidden Limit

Here’s a surprise I didn’t see coming. Most dental plans have a low yearly limit—usually only $1,000 or $2,000. My full implant bill was $4,800. Insurance paid just $1,500 and I had to pay the rest. Once you use up your yearly max, you get nothing more until the next year.

Waiting Periods: No Instant Gratification

Don’t think you can just buy a dental plan and then quickly get an implant and have insurance pay for it. Most plans make you wait—usually six months up to two years—before they’ll pay for expensive stuff like implants. If you’ve just bought your plan, always ask about the waiting period.

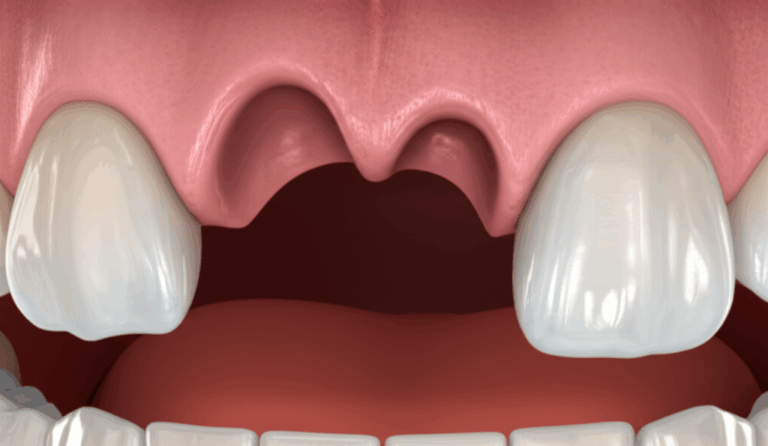

Pre-Existing Conditions and Exclusions

If you lost your tooth a few years ago, your insurance might say it’s a “pre-existing condition” and deny help for a new implant. Even if they say yes, they often say no to things like bone grafts or abutments, which you usually need with implants. These little “no’s” are often hidden in tiny print. That’s why I tell everyone: read your policy closely.

Finding Insurance That Does Cover Dental Implants

If you’re feeling like giving up, hang in there. Not all insurance skips out on implants. You just need to know what to look for.

High-End Dental Insurance Plans and PPO Networks

I hunted for “implant-friendly” plans. It took a lot of time, but I did find some PPO dental plans that pay for implants as big dental work. Usually, they’ll pay about half after your deductible and only up to your yearly max. If you work somewhere with dental insurance, check if your plan pays for major work and if implants are in their list.

Tip: Stay in-network. You’ll get more coverage if your dentist is in their PPO network.

When Medical Insurance Steps In

This really surprised me. Sometimes, health insurance—not dental—can pay for implant surgery. But don’t expect them to pay for a nicer smile. Medical plans will only help if you need implants because of an accident, tumor, birth problem, or real health problem. You need to have strong proof—X-rays, doctor notes, and referrals—showing this isn’t for looks.

One friend lost front teeth in a bike crash, and his medical insurance paid for most of the surgery. But he still had to fight to get the crowns covered by dental insurance.

Dental Discount Plans: A Different Way to Save

Discount plans aren’t real insurance, but I’ve used them myself. You pay a yearly fee and then get lower prices at some dentists. For implants, you might get 15–50% off. Not every dentist takes these, so always ask before you sign up. You won’t get free implants but it does help cut the price if you have no other coverage.

Coverage for Seniors and Veterans

If you’re a senior or veteran, you might get extra help. Some Medicare Advantage plans have dental and some pay part of implant work—but you have to look at the rules. Veterans with serious dental needs can sometimes get help from the VA, but not everyone is covered.

My Best Strategies for Maximizing Implant Coverage

Once you find a plan that pays a little, here’s how I stretch every dollar and keep my bills down.

1. Pre-Authorization and Predetermination

Before you get work done, ask your dentist’s staff to send a pre-authorization or “predetermination of benefits” to your insurance. This is just a fancy way of saying: “How much will you really pay for this?” I never skip this step now. It shows you what you’ll owe and saves you from big surprises later.

2. Splitting the Procedure Over Two Plan Years

A lot of people don’t know that getting an implant usually takes a few visits—like pulling the tooth, then bone grafts, then placing the implant, and finally putting on the crown. My dentist helped me split up the work. We did half before December and half in January, so insurance paid twice, using two years’ worth of yearly limits.

3. Making the “Medical Necessity” Case

Using words like “having trouble eating” or “problems speaking” can help with insurance. If missing teeth mess with your health, get your doctor or dentist to write a note and include X-rays and anything else. Sending in a strong “medical need” request got my cousin some extra coverage when just asking didn’t work.

4. If They Deny You: How to Appeal (Don’t Give Up!)

I’ve had my claims denied plenty of times. Don’t just give up. Every insurance company has a way for you to fight the denial. Find out why they said no, then gather old and new doctor notes, X-rays, and more proof. My appeal finally worked after my specialist wrote a long note saying why implants (not false teeth) were needed for my jaw. Your dental office can often help—they know what words to use.

5. Break Up the Bill: Getting Parts Covered

Sometimes parts like pulling the tooth, the bone graft, or the first (temporary) tooth are paid for, even if the implant isn’t. If my insurance said no to the implant, they sometimes paid for other pieces. Ask your dentist about this. Tiny steps sometimes add up to real savings.

What If Insurance Isn’t Enough? Alternatives I Explored

Even with the best insurance, you’ll often pay a lot out of pocket. Here’s how I got creative and found ways to save.

Dental Financing Solutions

I didn’t have stacks of cash, so I used payment plans. Companies like CareCredit and LendingClub offer loans just for dental and health work—sometimes with no interest if you pay them off fast. My dentist’s office also had a payment plan, letting me pay little by little over a few months.

Using HSAs and FSAs

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), use it now. These accounts let you pay for dental and health bills with pre-tax money. When I had to pay a big implant bill, using my HSA felt way better than using my regular bank account.

Dental Schools: Surprisingly Affordable

Dental schools will treat you for much less because students (with teachers watching) do the work. You need patience—visits can last longer—but you’ll save big, sometimes more than half the price. My brother got his implant at a school and saved over $2,000.

Dental Grants and Charitable Aid

I searched online for “dental implant grants” and found some help for people with big health needs or low money. These programs are hard to win—not everyone gets picked—but if you do, they sometimes pay for all or most of the cost. Local charities also help, especially in large cities.

Negotiating with Your Dentist

Don’t be afraid to ask—lots of dental offices give discounts for paying cash or if you get more than one implant. When I asked, “Can you help lower my out-of-pocket cost?” I got 10% off. Some will let you spread payments out for free.

Picking the Right Insurance and Dental Provider

If I learned one thing, it’s that who you go to, and which plan you pick, matter a lot.

Why Your Dental Office Matters

Now, I only go to offices where the staff know a lot about dealing with insurance. The best places send pre-authorizations, follow up with insurance, and explain payment options in a clear way. If the office is upfront and helpful, it saves you stress and money.

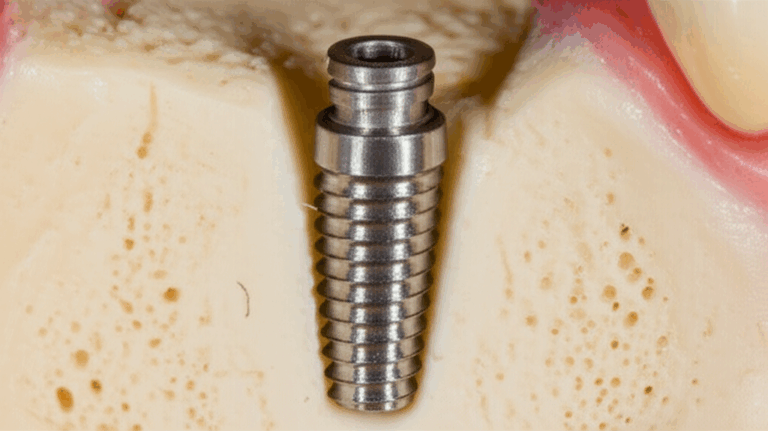

If you want special types of implants, or want to look at different options, you should check out labs that use up-to-date technology—like a digital dental lab or an implant dental laboratory. These options can sometimes give you better results and make your implants last longer.

Comparing Dental Plans the Smart Way

Before you buy a plan, look for:

- Yearly maximums (the higher, the better)

- Coverage for big procedures

- How long you wait before getting coverage

- Rules on old problems

- Deductibles and how much you share the cost

Call the insurance company. Ask, “Will this policy pay for an implant if I lost my tooth a few years ago?” If they can’t give you a simple answer, look for another plan.

And always remember—using dentists in your plan’s network keeps your costs lower. Dentists outside your network charge you much more, so always look them up first.

Conclusion: Take Control of Your Dental Implant Journey

Getting insurance to pay for dental implants is tough—I know because I’ve been through it all. But if you learn the rules and don’t give up, you can get a lot more covered and spend less from your own pocket. Always ask for pre-authorization, split your treatment when you can, prove why you need implants for health reasons, and never let a quick “no” stop you. Try every good way to help with costs—grants, discount plans, dental schools, and payment plans.

Dental implants are worth it—they help you eat, talk, and smile without worry. No matter where you are in your journey, don’t give up. The savings and the new smile are worth it.

FAQ: Common Questions I Get

How much do dental implants cost?

The average for one implant (with post, abutment, and crown) is about $3,000 to $6,000, sometimes more for harder cases.

Does most dental insurance cover implants?

About 30-50% of dental PPO plans pay something for implants, usually half the cost, but yearly benefits top out at $1,000–$2,000.

Will medical insurance pay for dental implants?

Almost never. Unless you lost teeth from an injury or illness, medical plans usually say no to implant bills.

What can I do if my insurance claim is denied?

Always try again, send more notes or proof, and ask your dentist for help with a new letter. Sometimes you just need to explain things better (and not give up).

Are there cheaper options than implants?

Yes—bridges and dentures cost less. Implants are the closest thing to a real tooth. If you want to see the good and bad points, check out more about dental problems.

Want more info or help for your own case? I’m always happy to share what I know. Start talking with your dentist and your insurance company today. You might be surprised how much a determined patient can get!