Does Your HMO Cover Dental Implants? My First-Hand Guide to Coverage, Costs, and Alternatives

Table of Contents

- 3.1 Medical Necessity vs. Cosmetic

- 3.2 Types of HMO Plans

- 3.3 The Importance of Plan Details

- 3.4 In-Network Provider Rules

Introduction: The Short Answer (and Why It’s Complicated)

If you’re here, you probably sat there looking at your HMO card and wondered if it could help you pay for dental implants at all. I’ve been in that spot too—big dental bills, lots of confusion, and not much real help showing up. Here’s the plain truth: most HMO health plans do not pay for dental implants. But—this is important—some HMO dental insurance plans might help a little. Still, even those plans usually have tight rules and small print.

I’ve seen people get stuck by all that confusing fine print. Each HMO can be different, and just because you think something is covered, doesn’t mean your plan sees it that way. You might get told your implants look “cosmetic” so they don’t count, or your dentist could be outside their list, so no help for you. I’ll help you see how it all really works, what to ask, and how to keep your own bills as low as you can.

Understanding HMOs and Dental Benefits

What Is an HMO?

Let’s break it down. An HMO, or Health Maintenance Organization, is a kind of health insurance that likes you to stick inside their own group of doctors and places. When I had my first HMO job plan, I had to pick one main doctor. If I wanted anyone else, I had to get a referral first or pay full price out of pocket if I went outside the group.

It works the same with dental plans. You get a list of approved dentists. Go to someone not on the list? You pay the whole bill.

Medical vs. Dental Coverage

Here’s what surprised me when I really needed dental work: your normal health insurance (even with an HMO) usually doesn’t help with dental work at all. Unless your teeth problem comes from something like a bad injury or surgery, your health HMO says, “Nope, not my job.”

You need a separate dental HMO for regular cleanings, fillings, or maybe big stuff like bridges or dentures.

HMO Dental Plans

Not all dental HMO plans are the same. Some are bundled with your medical, others you buy by themselves. But almost all focus on cleanings, exams, and maybe small tasks like fillings or pulling a tooth. If you need something bigger, like a crown or root canal, you’ll hit more rules and pay more yourself. Implants are a whole other problem, which I’ll get to soon.

Once I was looking around on an implant dental laboratory site, and wow, these things can cost a lot! Even with better HMO dental plans, implants are often called a “want” not a “need,” so most times you’ll be on your own to pay for them.

Key Factors Influencing Dental Implant Coverage by HMOs

Medical Necessity vs. Cosmetic

In every insurance talk, the big question is simple: “Do you need this for your health, or do you just want it?” If you lost a tooth in a weird accident, or if you need to rebuild after surgery, your HMO might say implants are “needed” for your health, and maybe they’ll pay a bit. But for regular missing teeth from decay or daily life? They say it’s only for looks, and you’re out of luck.

One time my neighbor got some help with implants after wrecking his bike and breaking a tooth. But another friend who just wanted to eat and chew better got denied by the same insurance. That “medically needed” rule can be the whole difference.

Types of HMO Plans

Who gives you your insurance—your job, a union, or just you? That matters a lot. Work plans (especially at bigger places) can have better perks. Plans you buy yourself are usually cheaper, but you get less. It’s like flying first class or way in the back of the plane—you’re going to the same place, but it sure doesn’t feel the same!

The Importance of Plan Details

Don’t just glance at your plan—read it real close. Watch for:

- Deductibles: How much do you pay before they help?

- Coinsurance and Copays: What chunk of the bill is yours?

- Yearly Maximums: Is there a limit on what they’ll pay each year? A lot of dental HMOs only pay $1,000–$1,500 a year, which won’t go far with implants.

- Waiting Periods: Some make you wait 6–12 months before big stuff counts. I once missed coverage on a crown because I changed plans and didn’t see there was a wait.

In-Network Provider Rules

HMO’s make you stick to certain dentists. For implants, only a handful in the network might even do the work the plan covers.

I remember when I called a dozen oral surgeons from my plan—most didn’t do implants, and the rest had super long wait times. So annoying.

If you struggle to find a local dentist for something tricky, check if the dentist works with a good digital dental lab. Some network offices use outside labs for special stuff to keep the price down.

What HMO Dental Plans Typically Cover (and What They Don’t)

Commonly Covered Services

Let’s keep it simple. Most HMO dental plans cover things like:

- Teeth cleanings

- Dental checkups and x-rays

- Fluoride (sometimes)

- Fillings

- Simple tooth pulling

Most people get these every year with low or no cost. Cleanings and little jobs are what dental HMOs are built for.

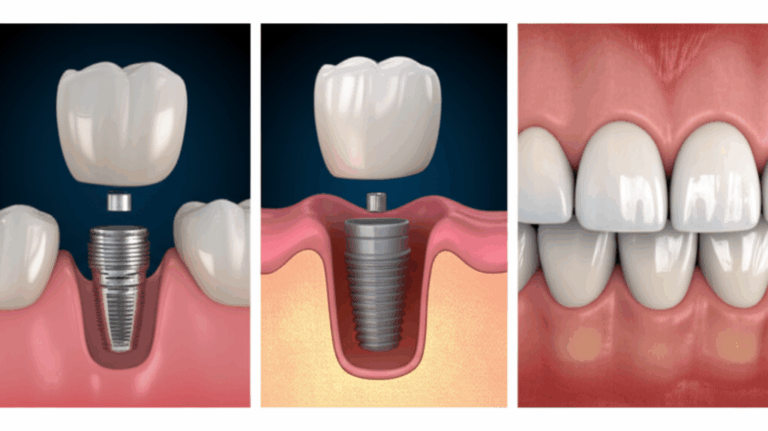

Major Dental Work and Implants

Need something big, like a bridge or a crown? It gets harder. Sometimes you get help, but you’ll still pay plenty. I got a little for my crown once, but had to pay the rest.

Dental implants? With most HMO plans, it’s a flat “no.” They put it in the “for looks only” category—even though missing teeth are a health issue too. A few plans might help if you meet their “medically needed” rules, and only certain teeth might even count.

I looked at info from big insurance companies: less than 10% of dental HMO plans give any money for implants, and you’ll need pre-approval and to prove you really need it.

Pre-Authorization and Claims

This step is a beast. You usually need your provider to send in a treatment plan before you book surgery—and they have to approve it, not just know about it. Skip this and your claim is toast. You’ll pay everything yourself.

My dentist once showed me all the codes and letters he sent for pre-approval. I couldn’t believe how much goes into it. So always check before starting!

How to Verify Your HMO Dental Implant Coverage

Where to Find Answers

You’re not alone in this. Here’s what I do every time I wonder about coverage:

Key Questions to Ask

I always ask:

- Do you cover dental implants? If yes, when?

- Is it just when needed for health? What counts?

- Are there any waiting periods or do I need OKs ahead of time?

- What codes do you cover?

- What’s the maximum per year or lifetime?

Write down who you talk to and when—it helps if things get confused later.

Partnering With Your Dentist or Surgeon

The people in your dental office can help lots. My oral surgeon’s team once helped me look up every little rule in my plan and sent in requests for me. Some dental offices work with good dental labs, like a removable denture lab or a crown and bridge lab. Their experience really helps and can give you the best shot at some insurance help.

Alternatives When Your HMO Doesn’t Cover Dental Implants

Let’s be real: your HMO probably won’t pay much (if anything) for implants. Here’s what I did or saw friends do when the insurance door slammed shut.

Other Insurance & Savings Plans

PPO Dental Insurance: These plans pay for more stuff (sometimes implants), but you pay more each month, can use more dentists, and still get yearly limits. If you switch to PPO, don’t wait—waiting periods count!

Supplemental or Extra Dental Plans: I once bought a separate plan for a year, just hoping for more help with implants. It paid for a few things, but I was still stuck with most of the bill.

Dental Discount Plans: These aren’t real insurance. You pay a membership fee for lower prices—sometimes 20–50% off. If nobody around you takes your HMO, this helps.

Mix & Match Benefits: Sometimes you can use your HMO for things like pulling teeth or x-rays, then a discount plan or PPO for the implant itself. It takes extra work, but saves more.

If you want to see how pros build implants, checking out an implant dental laboratory is good. You’ll see the different qualities and prices.

Dental Schools

This is a big one people skip. Dental schools often do implants and big jobs for way less money—sometimes half price. The work takes longer, and you’ll see students (watched by pros) using new tools. I sent a friend there and she saved a ton. But the tradeoff is slow scheduling.

Financing and Grants

If you have a giant bill, try:

- Healthcare Credit Cards: Like CareCredit. Pay over a year or two, sometimes no interest if you pay in time.

- Personal Loans: Your local bank may give better deals if your credit is good.

- Payment Plans: Lots of dentists will let you pay month by month. Just ask.

- Dental Grants and Charities: Some programs help if you really need it or can’t pay. Search “dental implant grant” and put your city.

Dental Tourism

Not for everyone, but some people go overseas (Mexico, Costa Rica, Thailand) for cheap dental care. You can save a lot, but you need to check the dentist’s skills and if it’s safe. Don’t let a low price make you take a bad risk.

Tips for Affording Dental Implants (Even Without Full HMO Coverage)

Here’s what I learned to bring my bill down—even if my insurance did almost nothing:

- Shop Around: Get more than one quote. Some dentists charge way less for the same job.

- Space Out Your Treatment: Some dentists let you split things up—extractions one year, implants the next—so you can use yearly benefits two times.

- Use What You Have: Sometimes, your HMO plan pays for things like x-rays or pulling a tooth. Use that help before paying out of pocket for the rest.

- Negotiate: Don’t be afraid to ask for deals. Some dentists give discounts for cash, seniors, or will set up payments. You just have to ask.

- Plan Ahead: If you know you’ll need an implant next year, try to sign up for a better plan as soon as you can—before your tooth really breaks.

- Try New Materials: Some offices have new, sometimes cheaper options like mini-implants or 3D-made crowns from a good zirconia lab or emax dental lab. Ask if these could save you money.

Conclusion: Making an Informed Decision

Here’s my main lesson: never just guess about insurance—especially for big things like implants. Every plan draws the line somewhere else, and they hide that line in the fine print.

Take control:

Dental implants really change your life. They cost a lot, but if you ask the right things and work a little harder, you get a better shot at affording it—your way, not the insurance company’s.

It’s worth it every day you can eat, smile, and talk with less worry. So don’t quit. Check around, talk to people, and get the best you can!

Want to know more about dental implants, other special treatments, or common teeth problems? Check out my favorite resources like dental implant and dental problems for ideas and real answers.