Does Wellpoint Cover Dental Implants? My Complete Guide to Benefits, Costs, and Making Sense of Your Options

Table of Contents

- 4.1 Medical Necessity vs. Cosmetic

- 4.2 Waiting Periods

- 4.3 Annual Maximums

- 4.4 Deductibles, Copays, and Coinsurance

- 4.5 Prior Authorization & Pre-Treatment Estimates

- 4.6 In-Network vs. Out-of-Network Dentists

Introduction: My Journey Through Dental Implant Costs and Insurance

Let’s be real—if you’re here, you’re probably scared about a big dentist bill. I’ve been there too. When my dentist said my tooth had to go, I was shocked by how much the next steps would cost. When I first heard about dental implants, my first thought was, “Will my insurance even pay for this?”

I’ve fought through all the red tape, read Wellpoint’s paper stacks, and talked to more insurance people than I can count. It’s confusing, but I want to make it simple for you—with normal words, real-life stories, straight answers, and all the tips I wish I knew at the start.

The idea is simple: help you really see how Wellpoint (now mostly called Elevance Health and sometimes Anthem) looks at dental implant coverage. I’ll explain what’s paid for, what’s not, and all the ways to get the best bang for your insurance dollar.

The Core Question: Does Wellpoint (Anthem/Elevance Health) Cover Dental Implants?

Here’s what really matters:

Yes, Wellpoint might help pay for dental implants, but it never covers all of it, and how much you get depends a lot on your exact plan.

I wish insurance would just answer “yes” or “no,” but it’s always in the middle. Most of the time, they put implants in a group called “Major Restorative Services.” This usually costs more and comes with extra rules. Wellpoint also changes their name a lot—sometimes it’s Elevance Health, other times Anthem. But for you, the rules don’t really change.

So, it’s not “Will Wellpoint help?” but “How much will they pay, and what hoops do I have to jump through?”

Wellpoint Dental Plans: How Coverage Works for Implants

After spending what felt like forever reading insurance rules (wishing my toothbrush was a magic wand), I found out your plan choice is everything. Here’s the rundown:

PPO Plans

I picked a Wellpoint PPO because I wanted to choose my own dentist. PPO (Preferred Provider Organization) plans give you more choice:

- Higher Monthly Cost, More Choice: I paid more each month, but I had a much bigger list of dentists.

- Major Work Included: My plan said it would pay 50% for “major work,” including implants. But this stops once you hit a yearly max (more on that soon).

- Going Out-of-Network Costs More: If I went to a dentist not on their list, they paid even less, and I had to pay more.

HMO Plans

I tried an HMO (Health Maintenance Organization) dental plan too, because it was cheaper. Here’s the deal:

- Cheaper Monthly Cost, Small List: I could only pick dentists from their short list. Lots of paperwork for referrals.

- Rarely Covers Implants: Most Wellpoint HMOs didn’t pay for implants, except sometimes if you really needed them for your health, and only with lots of paperwork.

- Only Plan-Approved Dentists: If my dentist didn’t send me to someone they liked, no money from Wellpoint.

Indemnity and Discount Plans

I checked out these other choices too:

- Indemnity Plans: These plans let you pick anyone and pay a little back, but never enough to come close to covering an implant.

- Discount Plans: These aren’t insurance. Wellpoint’s versions just gave me a lower price, helping some, but still not a big help.

Medicare Advantage & Medicaid

I helped my parents with their dental stuff, too:

- Medicare Advantage: A few Wellpoint Medicare Advantage plans have some dental care, but usually not implants—unless you pay extra for a special add-on.

- Medicaid: What’s paid for depends on your state. Where I live, Medicaid only paid for pulling bad teeth or emergencies, not implants.

Factors That Influence Wellpoint Dental Implant Coverage

After digging into the fine print, I learned these things decide if Wellpoint pays for my implant or not.

Medical Necessity vs. Cosmetic

Medical need is super important. If missing a tooth makes it hard to eat or causes bone to shrink, and your dentist can prove it, you’re more likely to get help.

Cosmetic work (just for looks) is almost never paid for. Want an implant just to fill a gap that doesn’t cause problems? Sorry, you’re paying yourself.

Tip: Have your dentist write down if you have trouble eating, talking, or bone changes. Showing this helped me get part of my bill paid.

Waiting Periods

Most Wellpoint dental plans make you wait 6 to 12 months before they help with big stuff like implants. They do this so folks don’t sign up, get expensive work, and drop out.

But, if you already had dental insurance before, they might skip this waiting period. Make sure to keep your old plan papers—it helped me not have to wait.

Annual Maximums

Here’s the part that shocked me. Most plans will only pay $1,000 to $2,500 a year.

My implant cost $4,000. Even if they pay 50%, the highest they’ll pay is $1,500 for that year. The rest? Up to me.

Deductibles, Copays, and Coinsurance

Before insurance pays anything, you pay a deductible (usually $50-$150 a year). Then you pay a chunk of the rest, called coinsurance (often half for big stuff).

So if an implant costs $4,000:

- $150 deductible: I pay this first.

- Insurance pays 50%: $2,000, but only up to the yearly max.

- My part: At least $2,000 plus anything over the yearly cap.

Prior Authorization & Pre-Treatment Estimates

Don’t make my mistake—starting before Wellpoint gives the green light. For big work, they usually want to approve it first. My dentist sent them my treatment plan and x-rays, and we had to wait for the OK. When it came, we knew what they’d help pay for.

Start early. And don’t feel bad about calling Wellpoint for help or for a form to see what they will pay.

In-Network vs. Out-of-Network Dentists

With my PPO, going to a dentist on their list saved me a lot. If not, insurance covered less, and I paid more. HMO plans won’t pay for work done by a dentist they don’t know.

Some dentists also use digital dental labs that make new teeth quickly and for less money. You can hear about these when you shop around for a dentist.

What Parts of an Implant Procedure Are Usually Covered?

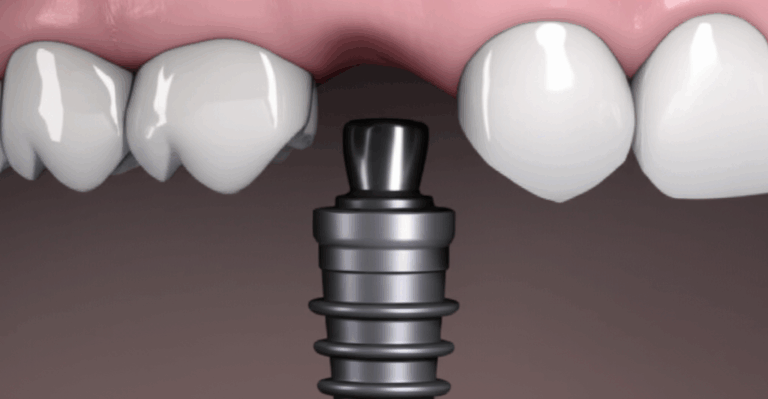

Here’s what tripped me up: “Implant coverage” doesn’t mean they pay for everything. Here’s what’s usually included and what’s not.

- Usually Covered:

- First dentist visit and x-rays

- Pulling a tooth (if needed for the implant)

- The screw (“implant”) put in your jaw

- The custom piece and the crown on top

- Sometimes Yes, Sometimes No:

- Bone grafts or sinus lifts (needed if your bone is too thin—sometimes Wellpoint pays, sometimes not)

- Full sleep or IV drugs (only if really needed for health reasons)

- Hardly Ever Covered:

- Just for looks (implants for gaps with no health reason)

- Rare or new ways that aren’t proven yet

My advice? Ask your dentist for a full list of steps and which ones they think Wellpoint will help with.

How I Verified My Wellpoint Dental Implant Benefits

I won’t lie—the hardest part was finding out my actual benefits. Here’s what worked for me.

- The Summary of Benefits and Coverage (SBC) was my friend. Look for “Major Services.”

- The big rule book is boring, but it has the details. I made myself read it.

- Their member site shows what claims have been made, how much you’ve paid, and sometimes lets you ask questions online. It took me a while to click around and find implant coverage info, but I did.

- I learned that asking for specific dental codes (ADA codes) got better answers. For implants, I asked about D6010 (putting in the implant), D6056 (the connector piece), and D6058 (the crown).

- The call can take a long time, but it helps. Ask for a real cost guess before you start.

- Many dental offices know Wellpoint or Anthem well and will look up your benefits for you. My dental surgeon even did all the paperwork for pre-approval.

- They also know which dental labs make strong crowns and parts.

Dealing With Denials and Making Appeals

The sad truth? Denials happen—even when you do everything right.

Why it happens:

- Wellpoint says your case isn’t a health need

- You haven’t waited long enough

- You already hit your yearly max

- You didn’t get permission ahead of time

How I appealed:

This took weeks, but I finally got partial approval. The trick? Don’t give up and keep records.

Alternatives and Solutions When Coverage Falls Short

If Wellpoint’s help isn’t enough (let’s be honest, it often isn’t), here’s what worked for me:

- Dental bridges or fake teeth: These are usually cheaper and sometimes have higher coverage. Many people I know got a bridge first, then saved for an implant later.

- Payment plans: Many dentist offices let you pay over time. No big lump sum!

- CareCredit: This card helped me pay for my crown when my yearly limit ran out, but you have to watch out for high interest.

- Shop around: Dental schools near me charged less for implants—students did the work with teachers watching.

- Dental discount plans: Not real insurance, but gives you a discount if you use their list of dentists.

Smart Tips for Maximizing Wellpoint Dental Implant Benefits

Here’s what I learned that really helped me get the most out of insurance:

- Read everything: Know your plan—waiting times, yearly caps, deductibles, and what’s “cosmetic.”

- Ask for a cost estimate before treatment: Yes, it’s slow, but it gives you the real numbers up front.

- Stay with dentists on their list: PPOs pay more for these dentists, and prices can be lower.

- Plan your stages: I timed my implant and the crown in different years, so I got two annual maximums instead of one.

- Keep all paperwork: If you need to fight a decision, you’ll need every bill, letter, and explanation of benefits.

- Find dentists using good labs: Sometimes a great dental lab will make better parts and sometimes even for a lower price.

Conclusion: Taking Action for the Dental Health—and Costs—You Deserve

Dental implants can change lives, but insurance rarely makes it simple or cheap. With Wellpoint (or Anthem/Elevance Health), your main job is to read the fine print, plan ahead, and don’t give up if you get a “no” at first.

I learned myself—after lots of mistakes and hold music—that you need to ask lots of questions, push for answers, and fight any bad calls. You aren’t just a number; you want your health and your smile back.

Don’t do it all alone. Your dentist, Wellpoint’s help lines, and even different labs and ways to pay are all there for you. Use them all, and you’ll get closer to a strong smile—without emptying your wallet.