Does Concordia Dental Cover Dental Implants? A Clear Guide to Your Benefits, Costs, and Options

Have you been told you might need a dental implant and now you’re looking at your insurance card, wondering, “Does Concordia Dental actually cover this?” If you’re worried about a big dental bill, you’re not alone. Dental implants can cost a lot, and insurance rules can be confusing. But you shouldn’t need to be a lawyer to understand your benefits! This article will tell you what you need to know about Concordia Dental implant coverage—what’s included, what’s not, and how to find out what you really have.

In This Article

- Is Dental Implant Coverage Possible with Concordia?

- What Decides If You’re Covered?

- How to Check Your Concordia Dental Plan for Implant Coverage

- Should You Get Pre-Authorization?

- Smart Solutions if Coverage Is Limited

- Frequently Asked Questions

- The Takeaway: Your Confident Next Steps

Is Dental Implant Coverage Possible with Concordia?

Let’s get straight to the point: Yes, some Concordia Dental plans cover implants—at least a little—but not all plans do, and the details are important. Implants are called “major restorative” treatments, and dental insurance companies look at them very closely.

> Quick Answer: Concordia Dental might help pay for implant costs, but what you pay depends on your plan, if your need is “medically necessary” or just for looks, and which parts of the treatment you need.

Insurance rules for implants are full of fine print. Some plans don’t pay anything at all. Others pay a little, often not enough for the whole treatment. Looking through your policy can feel like searching for a lost earring in tall grass.

But don’t worry! By the end of this article, you’ll know how to figure out what your plan covers, what to ask your insurance rep, and what you can do if coverage is less than you hoped.

What Decides If You’re Covered?

Your Individual Concordia Dental Plan Type

Think of dental insurance plans as ice cream: they all start with a similar basic mix, but there are different flavors. Here’s how the main types matter for implant coverage:

- PPO (Preferred Provider Organization): Lets you pick any dentist (in-network or out). PPOs are most likely to offer some help with implants, but you’ll usually still pay a lot of the bill, especially after you reach your deductible.

- DHMO (Dental Health Maintenance Organization): You have to use their network, sometimes even pick a main “home” dentist. DHMOs cost less each month but often don’t cover implants at all. They usually want you to get something cheaper, like bridges or dentures.

- Indemnity Plans: These are rare and pay fixed amounts for each treatment, no matter which dentist you choose. If implants are included depends on the small print.

Employer-sponsored plans might be more generous than plans you buy yourself, but you should never guess—details are different for every plan!

Pro Tip: Always look at your own plan booklet or online member portal. Two people with the same “Concordia Dental” card might have very different coverage.

“Medical Necessity” vs. “Cosmetic” Implants

Your smile is personal, but insurance companies only care if you need the implant: Do you need it to eat or speak, or keep your other teeth healthy? Or is it just to look better?

- Medically Necessary: If you lost a tooth in an accident, lost bone, or can’t eat well, your dentist can write this down. Insurance is more likely to help then.

- Cosmetic: If you want an implant just to look better, and your chewing is fine, most plans (including Concordia Dental) won’t pay.

Example: A carpenter loses a front tooth at work, and chewing is hard. That’s a real need. But replacing a slightly crooked but good tooth for a straighter smile is usually “cosmetic.”

Policy Limits, Waiting Periods, and What’s Actually Covered

Even if your plan says “yes” to implants, there are other things to watch for:

- Annual Maximums: This is the biggest one. Most dental plans cover $1,000 to $2,500 per year for all dental work put together—implants often cost much more! You’ll pay the rest.

- Deductibles & Coinsurance: You pay a “deductible” before insurance pays anything. After that, you might still have to pay 20%-50% of what’s left (this is “coinsurance”).

- Waiting Periods: Just got dental coverage? You may have to wait 6-12 months for implants or other big treatments. Some plans even longer.

- Pre-existing Conditions: If you already lost the tooth before your coverage started, some plans don’t pay for work on it. Always check the fine print!

The “Parts and Pieces” of Implant Coverage

Dental implants aren’t just a single step—they’re more like a four-part job:

Every piece has its own code and insurance rules. Don’t feel bad about asking your dentist to spell out which parts will be covered and by how much!

How to Check Your Concordia Dental Plan for Implant Coverage

It can be confusing, but you don’t need to guess. Here’s how to be sure about your coverage:

1. Review Your Plan Documents

Every dental plan comes with a “Summary of Benefits” or “Evidence of Coverage.” These may be boring, but the answers are there. Look for “Major Restorative,” “Endosteal Implants,” or “Prosthodontics.” Pay attention to words like “implant,” “coverage percentage,” “annual maximum,” “pre-existing,” and “waiting period.”

2. Contact Concordia Dental Directly

Insurance words are often hard to understand, so talking to a real person is usually best. Call the number on your Concordia card (or look on their website). Be ready with:

- Your policy number.

- A list of clear questions:

- “Does my plan cover dental implants? Are the post, abutment, and crown all included?”

- “What’s my yearly maximum? How much have I used already?”

- “Is bone grafting paid for if I need it?”

- “Are there any waiting times?”

- “Do I need a pre-authorization?”

3. Team Up with Your Dental Office

Most dental offices have insurance staff who are really good at figuring this out. Give them your Concordia info and ask for a pre-treatment estimate. They’ll send your treatment plan to Concordia so you can see what’s covered—before you say yes.

Extra tip: This is called “pre-authorization,” and it can save you lots of problems and surprise bills.

Should You Get Pre-Authorization?

Short answer: Yes, if you can!

Why?

- No surprises. You’ll know up front what will be covered.

- Helps you plan. You’ll get a written quote you can use to plan your payments.

- Appealing is easier. If Concordia says no, you’ll have proof for an appeal.

How it usually goes:

Many dental labs work with dentists to make sure paperwork is right, so approvals go faster.

Smart Solutions if Coverage Is Limited

Sometimes the answer is “no,” or what Concordia pays is very low. But don’t give up—you have other choices.

A. Consider Covered Alternatives

Concordia Dental plans often cover other ways to replace teeth more than they cover implants. You can ask about:

- Dental Bridges: These connect to your natural teeth on either side. Bridges often get better coverage, but they do require working on the teeth around the missing space.

- Partial Dentures: These are removable and replace a few missing teeth.

- Full Dentures: Replace a whole row, and are usually cheaper.

If you want to see how these choices compare, you can read more about dental problems and what might fit for you.

B. Explore Financial and Discount Solutions

Even if insurance won’t pay much, there are ways to make it work.

Payment Plans: Many dental offices let you pay over time or use a finance company (like CareCredit) to spread out the cost.

Dental Discount Plans: These are not insurance but give you lower prices for services; you pay the reduced fee yourself.

Health Savings Account (HSA) or Flexible Spending Account (FSA): Pre-tax dollars in these can often be used on implants and related treatments.

Dental Schools: Some dental schools do implants for less, under doctor supervision.

Personal Loans or Credit Cards: Only as a last choice—interest costs can add up quickly.

Note: For high-tech dental work (like crowns or special ceramics), dental offices may use special labs, which can make a difference in both quality and price.

When Is a Dental Implant Right for You?

Dental implants aren’t for everyone. You might be a good candidate if:

- You are missing teeth and your gums are healthy.

- Your jawbone is strong enough (or you’re willing to have a bone graft if needed).

- You take good care of your teeth and go for check-ups.

- You’re healthy overall (some health problems or smoking too much can be a problem).

Implants might not be best if you have too little bone, or if health issues make surgery risky. In these cases, options like removable dentures or bridges might be a better, cheaper fit.

Frequently Asked Questions

Q: How long is the Concordia Dental waiting period for implants?

A: Most plans have a 6-12 month wait for implants. Check your plan’s “limits and exclusions” section for your exact wait time.

Q: I need bone grafting before an implant. Is that covered?

A: Sometimes. Bone grafts are covered on some plans, but not all. If it’s needed for the implant and your dentist writes this down, it’s more likely to be covered. Pre-authorization is important!

Q: My plan denied my implant claim. What should I do?

A: Ask Concordia for an Explanation of Benefits letter. It will tell you why you were denied. Your dentist might help by sending more information or filing an appeal. You can also send an appeal to Concordia yourself.

Q: Can I use an out-of-network dentist with Concordia?

A: If you have a PPO plan, yes—but you’ll probably pay more. DHMO plans usually don’t let you go out of network for any coverage.

Q: Will Concordia help with implant maintenance visits?

A: Cleanings are usually covered, even for implants. Maintenance or repair of the implant itself is usually “major restorative,” so it depends on your coverage and yearly max.

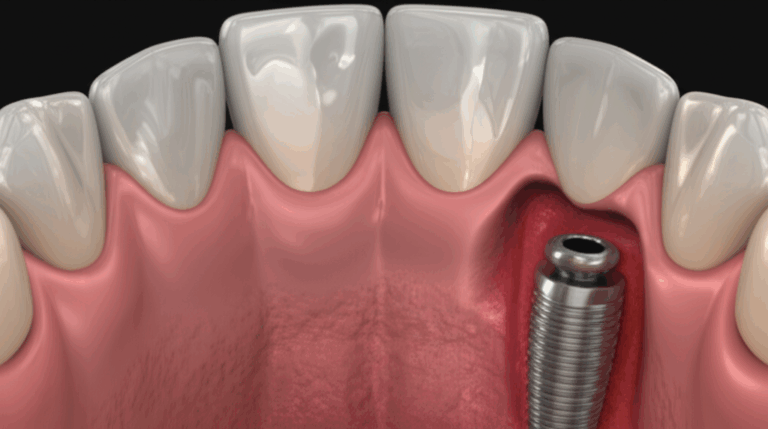

Q: Is the whole implant covered, or only the crown?

A: Often, the insurance will help with the crown, and maybe the abutment, but the implant screw itself is rarely covered. Always ask about each piece when you check your plan.

The Takeaway: Your Confident Next Steps

Let’s break it into simple steps so you can feel ready and at ease.

What To Remember

- Implants are sometimes covered by Concordia, but it depends completely on your plan.

- Implants are seen as major work—so you’ll often need proof you really need it, and there are limits and waiting times.

- Insurance might only pay for parts of the job, like X-rays or the crown, not always the metal screw itself.

- The only way to know for sure is to (a) read your Summary of Benefits, (b) talk to Concordia, and (c) have your dentist get a pre-treatment estimate.

- If implants aren’t covered or only partly covered, there are other treatments (bridges, dentures) and ways to save money (discount plans, payment plans, HSAs/FSAs, dental schools).

What to Do Next

The Bottom Line

Dental insurance can be confusing, but you don’t have to guess. When you ask the right questions and get help from your dental office, you can make the best choice for your teeth and your wallet. Remember, it’s not just about one tooth; it’s about feeling confident again. Always ask for help, compare different choices, and push for clear answers.

If you want to learn more about dental implants and new dental solutions, you can read up on dental implants and what’s new in restorative dentistry.

Here’s to a future with healthy smiles and fewer dental insurance hassles!

For more helpful dental guides and dental cost tips, keep following our learning resources.