Does Bupa Cover Dental Implants? Your Straightforward Guide to Bupa Dental Implant Insurance

That moment you get a quote for a dental implant and your eyes widen—yeah, we’ve all been there. For many people, dental implants are both something they want—getting back your chewing and confidence!—and something they worry about, because of the price. Naturally, the big question comes up: Does Bupa cover dental implants? Is this something my insurance can help me with, or am I on my own?

If you’re looking for answers, you’re not the only one. Every year, thousands of people in the UK, Australia, and other places look carefully at their insurance trying to find out if their Bupa dental plan will really help with implants, what rules they’ll need to follow, and how much will be left for them to pay.

You’re in the right spot. This guide will show you what Bupa dental insurance says about implants, what can change your coverage, what costs you might see, and most importantly—the steps that will help you finish this journey to a better, happier smile.

In This Article

What We’ll Cover:

- What Are Dental Implants, and Why Think About Them?

- The Direct Answer: Does Bupa Cover Dental Implants?

- How Bupa Dental Implant Cover Works (and What Changes It)

- The Dental Implant Steps: How to Work With Bupa’s Claiming Process

- How Much Do Dental Implants Cost (with and without Bupa)?

- Bupa Dental Implants: Common Questions and Choices

- Final Words: How to Make a Good Choice

What Are Dental Implants, and Why Think About Them?

Let’s start easy. If your dentist ever said a dental implant is “like getting a new tooth in your jaw,” that’s pretty close. A dental implant is a small metal or ceramic post that a dentist puts into the bone where your tooth was. Over time, the bone “accepts” this post, like it would your real tooth root. Then, your dentist fits on a custom tooth, bridge, or even a whole row of teeth if you need it.

Benefits of dental implants:

- They look, feel, and work just like your own teeth.

- They stop your jawbone from getting smaller after you lose a tooth.

- You don’t need to grind down healthy teeth, like with regular bridges.

- They can last many years—sometimes even your whole life—if you look after them.

That all sounds good, right? But here’s the big problem: the price. A single tooth implant can easily be £2,000–£3,500 in the UK or AUD $3,000–$6,000 in Australia—and that’s before extra work like bone grafts is included.

So, does Bupa help pay for all that?

The Direct Answer: Does Bupa Cover Dental Implants?

Here’s the real, simple answer.

Yes—Bupa dental insurance sometimes pays for dental implants, but it depends on your exact policy and what “big dental” benefits you have. It’s not part of every plan. The details—what’s in, what’s out, how much they pay, how much you pay—depend on some fine print.

If you have Bupa Extras Cover with “Major Dental” or a similar high-level plan, there’s a good chance implants are included. If you just have basic or general dental insurance, implants will almost never be included.

But just having the right plan name isn’t enough. Things like waiting periods, yearly limits, what percent Bupa pays, special dentist networks, and what the policy leaves out all shape what help you’ll really get.

Let’s break down how Bupa’s cover for dental implants really works.

How Bupa Dental Implant Cover Works (and What Changes It)

Types of Bupa Dental Insurance Cover

- This is the main Bupa insurance that covers implants. Most dental implants are counted as “Major Dental” in Extras policies, not “General Dental.”

- Major Dental also includes crowns, bridges, and tough surgeries.

- Plan names, like “Gold,” “Platinum,” “Ultimate Dental,” or “Total Extras,” give these benefits—but the details change.

- Hospital cover is sometimes needed for dental work under sedation or injury, but dental implants are almost never covered just by hospital insurance.

- Rare case: If you need mouth surgery in hospital after a big accident, a hospital plan may help.

Important: If you only have a simple “General Dental” plan, you’ll need to upgrade to get implant cover.

What Changes How Much Bupa Pays?

Bupa’s Extras Cover works like a stool with three legs: waiting periods, yearly limits, and what percent Bupa pays you back.

- For Major Dental (including implants), there’s usually a 12-month wait. You can’t just join, claim, and walk off with a new tooth. You need to have the plan for a year before this part kicks in.

- Already had a dental problem? Waiting periods still count, and some upgrades might need extra checks.

- There’s a top amount Bupa will pay for Major Dental each year.

- For example: £1,000–£2,500 in the UK or AUD $1,500–$3,000+ in Australia.

- This yearly limit covers all big dental work—crowns, bridges, braces, and yes—implants. So, needing a lot of work means you could reach your max fast.

- After your waiting period, Bupa pays a set chunk—normally 60% to 85% of your dentist’s charge (or Bupa’s set list).

- Your bill to pay (“the gap”) = Dentist’s cost – (Bupa’s payment, up to your yearly limit).

- Bupa Members First Dentists (or similar) are those who have special deals with Bupa.

- If you pick one, you may get more money back or lower, clearer prices.

- Go to a regular dentist? You can still claim, but you might get less money back.

- Not every implant gets covered. They often don’t cover cosmetic-only implants or if it isn’t needed for health reasons.

- Check your policy for details—sometimes, certain materials or kinds of work (like mini-implants) aren’t paid for.

Example: The Stool in Action

Say you have “Gold Ultimate Extras” with a £2,000 Major Dental limit a year and get 75% back. Your dental implant and crown together cost £3,000.

- Bupa pays 75% of £3,000 = £2,250

- But your yearly limit is only £2,000, so you get that.

- You pay the extra £1,000 yourself.

If the work is split over two benefit years, you could use your yearly limit twice and make the cost less upfront. Planning with your dentist can sometimes help a lot.

The Dental Implant Steps: How to Work With Bupa’s Claiming Process

It’s not just about the paper. How you plan your treatment and claim with Bupa can really change what you pay and how smooth the whole thing feels.

Step 1: Consultation and Treatment Plan

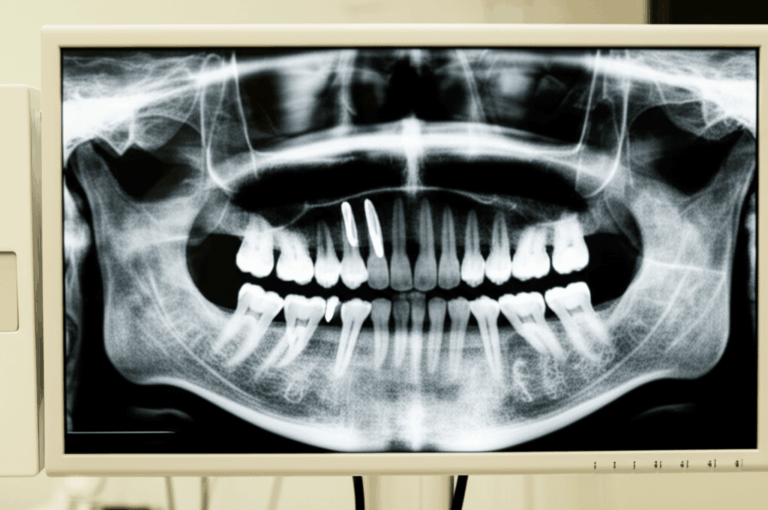

First, you need a dentist visit. Your dentist will take X-rays, check your gums and bone, and make a plan. They’ll list out every step, from pulling teeth to putting in the implant, maybe bone grafts, and the final tooth.

Tip:

Ask for a written, detailed quote, with dental item numbers. These are needed for Bupa’s pre-approval.

Step 2: Pre-Approval/Pre-Authorization

Don’t miss this step!

Bupa suggests (and sometimes asks for) sending in your treatment plan for pre-approval before you start.

How it works:

- Give Bupa your treatment plan and itemized quote.

- They’ll tell you what’s covered, how much, and what you might pay.

- You can do this online in most cases, and sometimes your dentist’s office can help.

Why do it?

No one likes surprise bills. Pre-approval means you know what to expect.

Step 3: Implant Surgery and Placement

This is when it happens. Your dentist or surgeon puts in the post, lets it heal, then puts on the crown.

A lot of the time, treatment is done in stages over months. Sometimes you can split the payments and claims over more than one year, so you can use your yearly limit better.

Step 4: Making a Claim to Bupa

- At the dentist: If you’re at a Bupa-approved office, you can usually claim right then through their system.

- Online/App Submission: You can upload bills and papers from home.

- Manual Claims: You can mail or drop off receipts and papers at a Bupa center.

What you need:

- Your itemized bill (with item numbers).

- Proof of payment.

- Any pre-approval letters or emails from Bupa.

Step 5: Follow Up and Aftercare

Don’t forget aftercare! Implants last much longer if you keep your teeth clean and visit your dentist often.

How Much Do Dental Implants Cost (With and Without Bupa)?

Let’s talk numbers so you don’t get caught off guard.

Usual Prices

- Single Tooth Implant:

- UK: £2,000–£3,500

- Australia: AUD $3,000–$6,000

- Full Mouth/All-on-4:

- UK: £10,000–£30,000+

- Australia: AUD $15,000–$40,000+

- Bone Grafts/Sinus Lifts:

- Extra £450–£1,500 (AUD $700–$2,000+), if needed

What Does Bupa Pay?

- With Major Dental cover & approved dentist:

- Bupa may pay 60%–85% of allowed price, up to your yearly limit.

- So you’ll usually have a gap to pay, often £500–£1,500+ for a single implant, depending on plan and dentist.

Example

Liam (Australia) has an Ultimate Extras plan, with $2,000 yearly limit and 75% rebate. Needs an implant that costs $4,000.

- Bupa pays $2,000 (hits the limit).

- Liam pays $2,000 himself.

Chloe (UK) needs a bone graft before her implant. Her Bupa Platinum policy covers Major Dental.

- Bone graft is needed for health; both it and the implant use up her yearly limit.

Where do these costs come from?

Sources are dental surveys in the UK and Australia, the dental associations, and Bupa’s own policy guides.

Bupa Dental Implants: Common Questions and Choices

Still have some “What if?” questions? Let’s cover the big ones.

“Does Bupa pay for bone grafts or sinus lifts as part of implant treatment?”

Yes, often—if you need it for the implant. But, the price counts toward your Major Dental yearly limit.

Always have your dentist send in a clear quote and a note explaining why extra treatments are needed.

“What if my yearly limit won’t pay the whole cost of an implant?”

Here are some ways to manage that:

- Spread out treatment over two benefit years (if your dentist’s okay with it).

- Use payment plans for the rest.

- Ask your dentist or Bupa about better timing to get more help.

“Are ‘All-on-4’ or full mouth implants covered differently?”

Not really. They’re counted as Major Dental, but since they’re so pricey, you’ll almost always hit your limit and pay the rest.

“What about choices to dental implants—does Bupa cover those?”

Yes, there are options:

- Dentures (full or part): These are often partly or fully covered under Major or even General Dental, with a lot less to pay yourself.

- Dental bridges: Covered as Major Dental on most plans. What you pay changes, but it’s usually less than implants.

For more on choices, check out this dental problems guide—it talks simply about good and bad points for common tooth replacement choices.

Should I pick an implant over other options?

Implants are the “best” way for one missing tooth. Bridges and dentures work too, especially if you have a tight budget or implants won’t suit you.

“Can I get Bupa cover for implants if I live outside the UK/Australia?”

Bupa works in many countries, including Spain and New Zealand, but each place has different plans. Always check for Major Dental or restorative dental and read the details.

Who Is a Good Candidate for Dental Implants?

Not everyone is right for dental implants. Here’s a quick list:

You might be good for implants if:

- You’ve lost one or more teeth and want a strong replacement.

- Your gums are healthy, and you have enough bone (but bone grafts are common).

- You don’t smoke a lot, or you’ll stop.

- You keep teeth clean and see a dentist regularly.

Implants might NOT be best if:

- You have bad gum disease or tough health problems.

- You’re under 18 (bone still growing).

- You’re only looking to change how healthy teeth look (if so, check veneers).

Talking these over with your dentist gives you the best idea of what’s right for you.

Your Empowered Next Step: A Check-List to Confidence

Let’s wrap up with the main points, so you can move forward, whether you’re ready for a consult or still deciding.

A Quick Recap in Simple Words

- Bupa often covers dental implants, but you must have the right Extras/Major Dental plan—and you’ll have waiting times, yearly limits, and maybe a few things not covered.

- You almost never get “free” implants with Bupa. Expect to pay some money yourself—usually hundreds to thousands per implant.

- Planning helps:

Get a written, detailed list and item numbers from your dentist.

Ask for pre-approval before treatment.

Time big work to use your yearly limits best.

- Bone grafts and other needed treatments are usually covered—but still use up your yearly limit.

- Other options like bridges and dentures are there and often cheaper—and Bupa usually helps with those too.

Takeaway—5 Simple Steps

- Look for “Major Dental,” “implants,” and “yearly limit.” If unsure, call Bupa.

- Make sure every job and item number is listed—Bupa needs this!

- This is the best way to avoid surprise bills.

- You’ll often pay less and know the price up front.

- Implants, bridges, and dentures have their place. Read guides on dental implants or even see what a crown and bridge lab can do for your teeth.

Final words:

Getting your smile back shouldn’t be confusing. With a bit of planning, good talks with your dentist, and the right Bupa cover, you can get through this journey with less worry and fewer money surprises. Your smile—and feeling better—are worth it.

Sources:

British Dental Association, Australian Dental Association, Bupa official rules and guides. All costs and cover details here are examples—look at your Bupa plan or contact support for your answer.

This article is here to help make things clear for patients and is not a replacement for dental or insurance advice. For questions about your cover, call Bupa or ask your dentist.

Quick links for more reading:

- Dental problems: Check your tooth-replacement choices.

- Dental implant: A simple guide to implant treatment.

- Veneer: Want other cosmetic fixes? See if veneers are right for your smile.

Remember: Clear info is better than too much. With the right facts, you’re always in control of your dental health—no matter what you face.