Does Ameritas Dental Insurance Cover Implants? Understanding Your Benefits

That worry about your missing tooth isn’t just about your looks. It’s about eating, talking easily, and feeling like yourself. If your dentist tells you that you need a dental implant, your first question probably wasn’t, “How does an implant work?” It was more likely: “Does my insurance pay for dental implants? If so, how much will I have to pay?”

You’re not alone. Dental implants are one of the most common and expensive ways to fix missing teeth for adults. If you have, or are looking into, an Ameritas dental insurance plan, you want simple, honest answers about what’s covered, how much it costs, and what to expect. Insurance can be confusing, like reading another language.

Let’s break it down together. No fancy words. No scare tactics. Just real talk about how Ameritas, one of America’s most popular dental insurance companies, treats implant insurance.

In This Article

- Ameritas Dental Implant Coverage: The Short Answer

- Key Factors Influencing Your Ameritas Dental Implant Coverage

- What Parts of a Dental Implant Does Ameritas Usually Cover?

- Understanding Your Out-of-Pocket Costs for Ameritas-Covered Implants

- How to Check Your Own Ameritas Dental Implant Benefits

- Tips for Getting the Most from Your Ameritas Dental Benefits for Implants

- What if Ameritas Coverage Isn’t Enough? Other Choices and Payment Plans

- Your Healthy Takeaway: The Simple Conclusion

Ameritas Dental Implant Coverage: The Short Answer

Let’s get straight to the main question. Does Ameritas dental insurance pay for implants? In many cases, the answer is YES—but there are rules, limits, and small print.

Here’s what you should know right away:

- Ameritas usually calls dental implants “Major Restorative” work.

- This gets partial coverage—not the full bill. Most people see around 50% covered (after you pay your deductible and stay under the yearly limit).

- Not every Ameritas plan pays for implants. The details, waiting times, and what’s covered depend on your certain Ameritas plan (like Dental Prime, Dental Max, or work group plans).

- And—maybe the most important—there are limits. That means you’ll have to deal with deductibles, yearly maximums, and maybe even a waiting period before insurance helps pay.

- Coverage depends on your implant being needed for health reasons (to replace a lost tooth) and not just to make your smile look better.

Implants are a big deal. Before you start, let’s take a closer look.

Key Factors Influencing Your Ameritas Dental Implant Coverage

Sometimes, insurance papers seem to need a secret code. But once you get used to it, you’ll see most dental plans—including Ameritas—work in similar ways. Here’s what changes if your Ameritas plan will help pay for dental implants:

Your Exact Ameritas Dental Plan

Not all Ameritas plans are the same. If you have a work plan, a personal plan (like Dental PrimeStar), or a PPO compared to HMO plan, what’s covered can be very different.

- PPO Plans (Preferred Provider Organization): Usually give you more choices for dentists both in and out of the Ameritas network. These often have better implant benefits.

- HMO Plans (Health Maintenance Organization): Often have tighter rules, sometimes don’t pay for implants, or only pay a little.

Levels count. Better plans (the ones with higher prices each month) often pay part of big procedures like implants, while simple plans might not.

Pro tip: Always check your plan’s benefit summary. If you’re picking a new plan and might want implants, compare what’s covered before you sign up.

Wait Times for Big Procedures

Got your new Ameritas card but need a dental implant right away? Not so fast.

- Wait times are normal for big procedures like implants—usually 6 to 12 months after your plan starts.

- If you had insurance before with no gap, this wait time might be dropped.

- For work group plans, wait times are sometimes shorter or dropped.

Why make you wait? Dental insurance companies don’t want folks to join only to get a big job done, then quit.

Yearly Maximums and Deductibles

Now, for the numbers—they really matter.

- Yearly Maximum: This is the most Ameritas will pay toward your dental work in one year, often $1,000 to $2,500. Implants cost about $3,000 to $5,000 (or more) for one tooth, so this money can run out fast.

- Deductible: You’ll usually pay a part (for example, $50–$150 every year) before Ameritas starts paying for big work like implants.

So, if your implant costs $4,000, your yearly max is $1,500, and your deductible is $50—you’d pay the first $50, then Ameritas might pay half of the next $1,450, and you’d cover the rest.

Coinsurance Rates for Major Work

Coinsurance is what you have to pay, after you pay your deductible.

- For implants, Ameritas usually pays 50%. You cover the other 50% out of your pocket, up to the yearly max.

- Sometimes, plan details change (like coinsurance of 40%, 60%, and so on), so always check your Benefits Summary.

Needed for Health vs. Just Looks

Implants are usually paid for only if they’re to replace a missing tooth from accident, injury, or sickness. If you just want to look better (“I want a super nice smile!”), Ameritas (and almost all insurance) will say no.

Supporting papers (like X-rays and treatment plans) often prove you need it for your health.

Pre-Approval Needed

Most plans now require pre-approval (pre-treatment estimate) before implant surgery. That means: “Ask us first so you know what’s covered.”

You, your dentist, or surgeon send papers to Ameritas. They check your plan, check if it’s allowed, and send back a benefits estimate so you’re not surprised.

What Parts of a Dental Implant Does Ameritas Usually Cover?

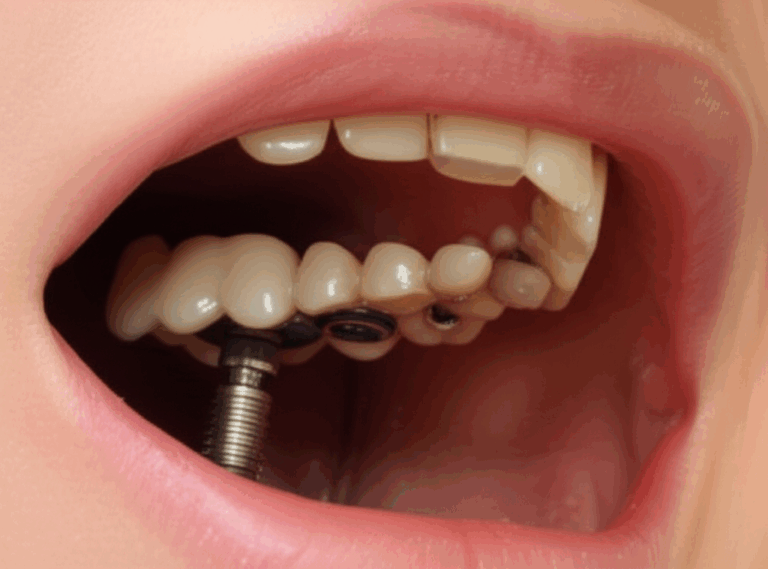

A dental implant isn’t done in just one step—it has a few stages:

Does Ameritas pay for all three? Sometimes, yes—but the amounts for each part can be different.

Typical Coverage Patterns

- Implant Post: Most often called “Major Restorative”—paid at 50% (once you pay your deductible and up to the yearly max).

- Abutment: Usually also as major work.

- Crown: Sometimes paid as major, but some plans pay a different rate, or call it a “prosthetic.”

Bone Grafts, Extractions, and Other Parts

- Bone grafts: Sometimes paid under a different part, like “oral surgery,” if you need it to get your jaw ready.

- Extractions: Usually paid as “basic” or “minor” work—often at a better rate.

- Sedation/Anesthesia: Not always paid. Sometimes you pay for this yourself.

- Implant-Supported Dentures or Bridges: Coverage changes a lot here. Always check your plan.

If you want all the tiny details (like dental codes and small print), ask your dentist or Ameritas directly, or work with a dental office that knows how to handle insurance.

Understanding Your Out-of-Pocket Costs for Ameritas-Covered Implants

Let’s be honest—implants cost a lot, even with insurance help. Here’s a simple way to see what you might pay and plan ahead:

Average Costs (Without Insurance)

- One Dental Implant: $3,000–$5,000 per tooth

- Implant Bridge: $7,000–$15,000 (depends on how many teeth)

- Implant Dentures (“All-on-4”): $20,000–$50,000 (or more) per upper or lower jaw

How Insurance Helps (Example)

Let’s look at the numbers.

Say your Ameritas plan pays 50% for implants, has a $1,500 yearly max, and a $100 deductible. If your implant costs $4,000, here’s what might happen:

If you need more than one implant, you might do one now and one next year, to use next year’s benefit too.

Watch out for these extra costs:

- Visits

- X-rays or 3D scans

- Sedation (IV anesthesia not always paid)

- Temporary teeth

Know the Costs Upfront

Always ask for a pre-treatment estimate from your dentist. This tells you the best guess of what you’ll pay with your insurance.

How to Check Your Own Ameritas Dental Implant Benefits

Don’t guess when it’s this important. Here’s how to get clear answers for you:

1. Read Your Policy

It sounds simple, but get out your Summary of Benefits or the full plan info (maybe called the Evidence of Coverage). Look for these:

- “Dental implant coverage”

- “Major restorative”

- “Yearly max”

- “Not covered items”

If you’re still shopping for plans, ask for the full plan details—not just the flyers.

2. Call Ameritas Customer Service

Have your policy number and info ready. Ask clearly:

- “Does my plan pay for dental implants? If so, what percent?”

- “What’s the max you’ll pay, and does it include implants?”

- “Are there wait times for big jobs?”

- “Do I need pre-approval?”

- “Are the related services—like abutments, bone grafts, or crowns—included?”

3. Talk to Your Dentist’s Office

Dental offices work with insurance every day.

- Give them your policy info.

- Ask them to check what your plan covers and ask for a pre-treatment estimate.

Many offices will talk with Ameritas for you and help you plan your dental work and money.

4. Ask for Pre-Treatment Estimate (Pre-Approval)

Before your implant surgery, ask your dentist or surgeon to send a pre-treatment estimate to Ameritas. This paper lets you see:

- Exactly what’s covered

- Your share of the cost

- Guess of what you’ll pay yourself

- Anything else Ameritas needs (like X-rays or a letter about health needs)

Tips for Getting the Most from Your Ameritas Dental Benefits for Implants

Dental benefits are “use it or lose it,” and the yearly max doesn’t roll over. How can you make the most of your benefit?

1. Use Dentists in the Network

- Ameritas PPO network dentists charge agreed lower prices.

- Staying in network means fewer surprise bills and often a smaller bill for you.

2. Plan Around Your Yearly Max

- If you need more than one implant or a lot of dental work, think about spreading it over two years. For example, have the implant post put in at the end of the year and finish with the crown after your max restarts.

3. Keep Good Records

- Save all your papers, pre-approval letters, and receipts.

- If you need implants after an accident or injury, make sure every doctor gives you good records.

4. Ask About Other Repairs (If Needed)

- If your plan doesn’t pay for implants, bridges, dentures, or more “regular” ways to fix teeth might be covered better.

- Ask your dentist—some jobs can be done at a crown and bridge lab or removable denture lab, giving you other choices.

What if Ameritas Coverage Isn’t Enough? Other Choices and Payment Plans

Let’s be honest. Sometimes, insurance money just isn’t enough—especially if you need lots of implants or have a low yearly max. It can be tough, but you do have options.

1. Payment Plans

- Many dentists offer payment plans where you pay a bit each month.

- Healthcare lenders (CareCredit, LendingClub, and others) can help you pay for implants with different payment options.

2. Dental Discount Plans

- These are not insurance—instead, you pay each year for discounts at dentists who join the program.

- Good if you have no insurance, or if your plan does not cover implants.

3. Flexible Spending Account (FSA) or Health Savings Account (HSA)

- If your job offers these, they let you save before-tax money for healthcare costs, including most implant costs.

4. Look at Other Insurance

- If you’re picking new insurance, shop for plans with higher yearly limits and big job coverage for implants.

5. Try Other Ways to Fix Teeth

Not every missing tooth needs an implant. Regular bridges, removable dentures, or partial dentures can fix your teeth and might cost less or be covered better by insurance.

Your Healthy Takeaway: The Simple Conclusion

Ready for the short version? Here’s what you really need to know about Ameritas dental implant coverage:

- Ameritas does pay for dental implants on many plans—but just a part, and not always.

- Everything depends on your plan: deductibles, yearly max, coinsurance, wait times, and pre-approval rules.

- Implant work has many different costs: the post, the connector, the crown—all covered a little differently.

- Get a pre-treatment estimate before you start. This is the best way to know your real cost.

- Make the most of your benefits by using in-network dentists, timing your work, and keeping your paperwork.

- If your plan doesn’t pay enough, ask about payment plans, savings accounts, or other ways to fix missing teeth.

- And most of all, don’t go alone—work with your dental team and Ameritas to know your options.

Take Action!

- Grab your dental insurance card—find your plan or log in online.

- Call Ameritas or your dentist’s office for a clear, step-by-step check.

- Don’t wait because you’re confused. Implants can help you feel and eat better, and there are more ways to pay than ever before.

Remember: You have the right to simple answers and the best care for your mouth. You should be able to eat, smile, and talk with confidence—without scary bills. So, take the next step today. Your future self (with a new, strong smile) will thank you!

Resources for Further Learning:

For more tips on better dental health, fixing missing teeth, or understanding insurance, check our library of patient articles or talk with your local dental team. You’re never alone in making your smile healthy.