Are Dental Implants Covered by Insurance? My Experience Navigating Coverage and Costs

Table of Contents

- When Implants Are Medically Necessary

- When Implants Are Considered Cosmetic

- Why Classification Matters for Coverage

- Dental Insurance: What to Expect

- Medical Insurance: Rare but Possible

- Medicare & Medicaid: What’s Actually Covered?

- Supplemental and Discount Plans

- Your Specific Dental Plan: PPO vs. HMO and More

- Reason for Tooth Loss

- Pre-Authorization and Documentation

- Plan Limitations: Deductibles, Maximums, Co-insurance, and Waiting Periods

- Pre-Existing Conditions and Replacement Limits

- Contacting Your Insurance Provider

- Getting a Pre-Treatment Estimate

- Reviewing Your Explanation of Benefits (EOB)

- Partner With Your Dental Office

- Financing Options

- HSAs, FSAs, and Discount Dental Plans

- Dental Schools and Low-Cost Clinics

- Negotiating with Your Provider

- Considering Alternatives: Bridges and Dentures

The Core Question: Medical Necessity vs. Cosmetic Procedure

The day my dentist talked about dental implants for my missing tooth, the first thing I worried about was insurance. “Are dental implants covered by insurance or just something for looks?” That one question sent me down a confusing road of words I never heard before. So let’s get straight to it.

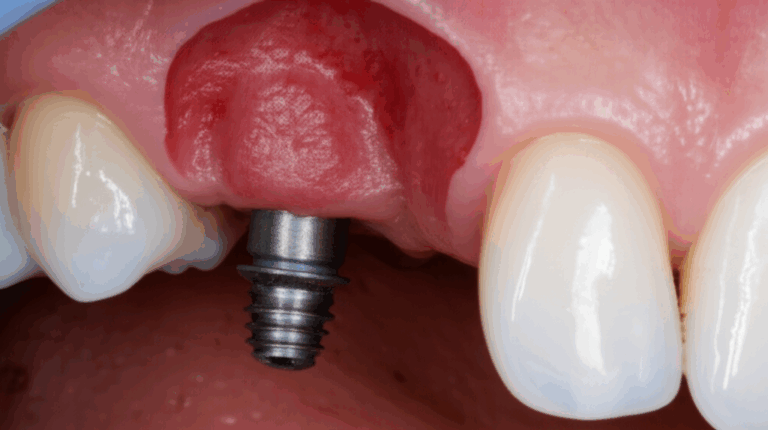

When Implants Are Medically Necessary

Let’s say, like me, you lost a tooth in an accident—or from sickness, like what happened to my uncle. In these cases, dental implants aren’t just about your smile. They help you chew your food, keep your jaw bone healthy, and stop your other teeth from moving all over. In dentist-speak, these are “medically necessary” reasons. When my neighbor lost teeth after a bike crash, his surgery wasn’t just for looks at all.

Insurance companies usually want proof that implants are needed for:

- Chewing and eating the right foods

- Stopping more mouth problems, like jaw bone shrinking

- Fixing problems from injury, illness, or trauma

When Implants Are Considered Cosmetic

Here’s the other side. If you still have your teeth, but want implants to make them “better” or to look nicer, that’s called cosmetic. Simply put: if you can still eat and talk, insurance probably won’t pay. One of my work friends wanted an implant for a little crooked tooth—her plan didn’t pay anything because it was her own choice.

Why Classification Matters for Coverage

I didn’t get why this was so important at first, but here’s the thing: Insurance companies only pay for things when they really think you need it for your health. If it’s just to look better, that’s cosmetic, and insurance almost never pays. It gets tricky because your dentist might think it’s needed, but your insurance might not.

The main point: How your insurance calls the implant decides if it’s covered at all, and which plan you’ll use.

Types of Insurance and Their Stance on Dental Implants

When I started checking if my implant would be paid for, I learned that not all insurance is the same. Your plan—PPO, HMO, Medicare, Medicaid, or whatever—sets the rules.

Dental Insurance: What to Expect

Most dental plans call implants “major restorative dental services.” In real life, this usually means:

- You might get 40% to 60% of the cost paid (after your deductible)

- There’s usually a yearly limit—often $1,000 to $2,500

- You might have to wait 6 to 12 months, sometimes longer, before it’s covered

- A pile of things might not be covered: Pre-existing problems, teeth lost before you got the plan, or things like bone grafting and fake (temporary) teeth

I found lots of plans list implants in the “not covered” or “limited” section. My PPO plan paid for part of the top and the crown, but not the metal part in my jaw. Some cheap plans pay nothing at all.

Looking for better coverage, I saw some companies—like Delta Dental, Aetna, or Cigna—have plans with bigger price tags that actually include major things like implants. But, again, there are always limits and tricky parts.

If you want to know these details, check under “Major Restorative” or “Prosthodontics” in your guide—or have your dentist’s office help you. Their help was a lifesaver for me.

Medical Insurance: Rare but Possible

I found out that medical insurance almost never pays for dental implants. The only times are for things like serious accidents, diseases (like mouth cancer), or birth problems—like being born without certain teeth. For example, a friend in a bad car crash got some of his procedure covered, because he needed it to live a normal life.

Usually, you need lots of paperwork and a strong case to get any help. Even then, health insurance might just pay for the surgery, not the fake tooth on top. For most people, don’t count on it.

Medicare & Medicaid: What’s Actually Covered?

Medicare, I found out fast, doesn’t pay for implants. Regular Medicare (Parts A & B) doesn’t cover routine dental, including pulling teeth, implants, or even basic fillings.

Some Medicare Advantage plans (Part C) give a little dental help, but these rules change all the time and almost never pay for all of an implant. Medicaid is all over the place: some states pay nothing for adults, while some pay a bit if you really need it. If you have Medicaid, call your caseworker and just ask about adult dental benefits—you might have to wait for someone to review your file.

Supplemental and Discount Plans

If normal dental insurance didn’t help, like it didn’t for me once, there’s still a little hope. Discount dental plans (or savings plans) can cut costs at certain dentists, but they’re not real insurance. You pay to join, then pay lower prices—sometimes 20-40% off. These help with big jobs, or if you need things like crowns or dentures.

Extra insurance just for implants is rare, but getting more common. Always ask what is really covered, and read all the tiny print.

Before you do anything, I say compare each choice to what you actually need. For example, if you’re picking between different labs and types of replacement teeth, knowing what your insurance pays for will help you decide what you can afford.

Key Factors That Influence Dental Implant Coverage

After lots of mistakes, appeals, and weird calls, these are the five things I always check before I let anyone start on my implant.

Your Specific Dental Plan: PPO vs. HMO and More

PPO (Preferred Provider Organization) plans normally let you pick any dentist but might make you pay more out of pocket. HMOs (Health Maintenance Organizations) cost less sometimes and sometimes cover more, but they make you use certain dentists.

Job dental insurance can be better, but if you buy it yourself, it might have more rules and lower yearly limits. I learned when I switched jobs—my coverage got worse moving from group to a single-person plan.

Reason for Tooth Loss

Insurance cares a lot about why you lost the tooth. If it was from an accident or illness just now, you might get coverage. But if you’ve missed that tooth for years, many plans won’t pay to replace it. Some have “missing tooth rules” so they don’t have to pay for lost teeth before the plan started.

Pre-Authorization and Documentation

Most implant work needs pre-authorization. That means your dentist needs to send x-rays, tooth codes, and a story about why you need it. If they skip this, you might have to pay for everything.

Sometimes they also want a pre-treatment guess (pre-determination). This helped me see what I’d owe before they started drilling.

Plan Limitations: Deductibles, Maximums, Co-insurance, and Waiting Periods

Dental insurance isn’t as good as health insurance. You’ll have a deductible (the money you pay first), then maybe insurance pays 40-50% of what’s left—if you don’t hit your yearly max. With implants costing $3,000–$6,000, you can burn that up fast.

I waited almost a whole year before my plan paid for any of my implant—because of a “big service” waiting period. Some plans make you wait just six months, some make you wait two years. Check this in your plan, so you’re not surprised.

Pre-Existing Conditions and Replacement Limits

Plans are very different about pre-existing dental problems. Some say, “Nope, we won’t pay for teeth lost before you signed up.” Others might pay, but only after you wait a while.

Another tricky thing: some plans only pay for one implant in a certain number of years. Always ask: “If this is a repeat, is it covered? Is there a time limit?”

Navigating the Insurance Maze: Practical Steps to Determine Coverage

Knowing what your insurance will pay isn’t easy. Here’s what I do every time—these tips work.

Contacting Your Insurance Provider

First, I get my card, find the number, and call. Simple, but the details matter. Here’s what I always ask:

- What’s the code for this implant?

- Is it a major service? What percent do you pay?

- Is there a waiting time for implants? How long?

- What is my yearly max? My deductible?

- Do you cover bone grafting or the top pieces?

Tip: Write down who you talked to, the date, and what they said. Saved me a ton during an appeal.

Getting a Pre-Treatment Estimate

Once you kinda know what might be covered, ask your dentist to send in all the codes for a price check. The insurance company sent back an estimate in about two weeks. Not a guarantee, but at least it gave me an idea.

Reviewing Your Explanation of Benefits (EOB)

After the treatment, you get an EOB—this lists what was charged and what you owe. My first one was a mess, but lining it up with my bill helped me see things I should fight if something wasn’t paid.

Partner With Your Dental Office

Here’s maybe the best advice: Let your dental office help. They deal with this all day! The front desk lady at my dentist was my insurance hero—she knew when my plan forgot to count my deductible, filed appeals, and explained all the weird numbers.

Getting help is even more important when you’re getting special types of replacements, which can mean extra insurance steps.

Alternatives and Cost-Saving Strategies

If the big cost of implants makes you panic, don’t worry too much. There are ways to make it easier if your insurance won’t help much.

Financing Options

A lot of dental offices let you pay over time, sometimes with help from groups like CareCredit. I did a payment plan for my second implant, paying over 18 months with no extra interest. Always check the fine print—sometimes the deal changes if you’re late.

HSAs, FSAs, and Discount Dental Plans

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), you can use that money for implants. This doesn’t lower the price, but you don’t pay taxes on it—works like a little discount just for using the right kind of account.

Dental discount plans let you pay every year for cheaper prices at certain dentists. You might save a lot if you’re paying for things like implants, dentures, or crowns.

Dental Schools and Low-Cost Clinics

Dental schools can give you really good care for less money. Students, with teachers watching, might do implants and other work. You’ll probably have to wait longer, but you’ll save a lot.

Some community clinics also work with dental schools, so look into those too.

Negotiating with Your Provider

Don’t be afraid to ask your dentist for a lower price—especially if you pay in cash or don’t use insurance. Some dentists might give 10-25% off if you ask. You can also check prices at other clinics, especially for big jobs.

Considering Alternatives: Bridges and Dentures

If the price is still too much—or your insurance says no—a dental bridge or regular denture might work. These sometimes get more insurance help, and you can always try for implants later if you want.

For big makeovers, look into all the different kinds of lab-made options. It might save money while you plan for future implants.

Conclusion: Making an Informed Decision

Getting dental implants paid for by insurance is almost never easy. My own experience taught me insurance loves to make it complicated—but it’s worth sticking with it. Whether you need it for your health or just want a better smile, the most important thing is to learn the details, ask lots of questions, and don’t trust that insurance will pay just because your dentist thinks you need an implant.

I always tell people to read every part of their dental plan, call the insurance company, and work with their dental office. If your insurance says no, look at payment plans, use tax-free accounts, or check out cheaper options. Everyone’s situation is different, so go in with your eyes open.

With the right info and a good list of questions, you can avoid surprises—and maybe even save thousands—when thinking about dental implants.